ZAMBIA’S economic engines are revving—copper output has risen 17 percent in six months, and fresh capital is fuelling expansion in mining, agriculture, and manufacturing.

Yet the country’s growth is constrained by a single bottleneck: insufficient electricity.

Without bold investment in energy infrastructure, these gains risk stalling, and the promise of a more prosperous Zambia could remain out of reach.

The 2025 Energy Forum for Africa (EFFA), held in Lusaka recently, sought to address this urgent challenge.

Government leaders, regional utilities, investors, and innovators convened to craft practical solutions to Zambia’s energy deficit.

At the forefront of these solutions is Stanbic Bank Zambia, which has committed over US$220 million to strategic energy projects across the country.

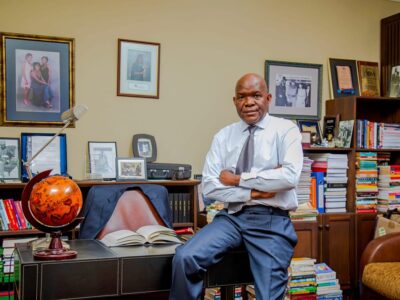

Chief executive officer, Mwindwa Siakalima, announced the financing package during the forum, which was officiated by President Hakainde Hichilema.

“Our purpose at Stanbic is to drive Zambia’s growth. Energy is a critical enabler of that growth, and we are proud to support investments that are helping the country meet both its short-term energy needs and long-term sustainability goals,” Siakalima said.

Read more: Stanbic urges innovative financing for large-scale energy projects

The bank had spearheaded major financing agreements, including US$55.5 million with Africa GreenCo to import 130 megawatts of power, US$71.5 million for a 100-megawatt solar PV plant under ZESCO subsidiary, Kariba North Bank Power Corporation, and US$96.7 million through the second tranche of CEC Renewables’ green bond to expand the Itimpi Solar PV Plant.

“These are tangible steps that reflect our commitment not just to Zambia, but to Africa’s energy future,” Mr Siakalima added, noting that these investments align with the Eighth National Development Plan, which positions energy as a key driver of mining, agriculture, and manufacturing.

Helen Lubamba, head of corporate and investment banking at Stanbic, highlighted the importance of Zambia’s policy environment.

“Progressive policies such as open access, faster ERB licensing, and cost-reflective tariffs have made it possible for us to back investments in the sector.

“Environmental and social considerations aligned to IFC and Equator principles are non-negotiable for Standard Bank Group,” she said.

Lubamba explained that financing structures were designed to draw repayment directly from project cash flows, requiring rigorous scrutiny of project viability, energy yield, and commercial sustainability.

She stressed that addressing “softer issues” around project implementation, including climate financing and environmental safeguards, remained critical to the success of these arrangements.

Hope Chanda, managing director of Mimshack Engineering Consultants, described the forum as a call to action.

“Africa needs homegrown solutions to solve its own problems. The continent is open not just to business, but to innovation and inclusive energy guided by sustainability. Zambia has the potential to become a regional electricity hub,” she said, noting that last year’s inaugural forum had already yielded the 100-megawatt Chisamba Solar Project, commissioned in June this year by President Hichilema.

President Hichilema emphasised the urgency of regional collaboration.

“We need to dismantle artificial boundaries in the power sector by investing in cross-border infrastructure that enables electricity sharing.

The Zambia–Tanzania interconnector is vital, not only for its return on investment but also for the market size and two-way trading opportunities it offers,” he said.

He further warned that recurring droughts have decimated economies, making it urgent to mobilise resources for infrastructure development.

Minister of Energy, Makozo Chikote, recently highlighted that several projects capable of adding 1,000 megawatts to the national grid cannot take off due to lack of financing, underscoring the need for stronger public-private partnerships.

Stanbic Bank’s investments demonstrate that private capital, paired with government commitment, can deliver both short-term stability and long-term sustainability. But more is needed.

“Zambia’s ambition to produce three million tonnes of copper a year will send electricity demand soaring, and we cannot meet that goal with today’s generation capacity or ageing transmission lines,” the bank noted.

Stanbic is actively financing a pipeline of projects that will diversify Zambia’s power mix.

Solar power and small-scale hydro are priorities, alongside mini-grids to supply rural communities directly.

Investments in transmission infrastructure, often overlooked, are also critical to ensuring electricity reaches all regions.

Recent policy reforms, including the 30-year Integrated Resource Plan, open access frameworks, faster licensing processes, and cost-reflective tariffs, are helping unlock private-sector investment.

The Southern African Power Pool further enhances investor confidence by providing a regional fall-back option for excess supply.

Energy security is not a luxury—it is a necessity. Aligning government ambition with private-sector ingenuity can transform today’s energy shortfall into tomorrow’s competitive advantage.

The time to act boldly and collaboratively is not next year or next quarter—it is now.

“At Stanbic, we are proud to be part of the solution. No country can grow faster than its power supply,”Siakalima said.

Zambia’s growth story is compelling, but only if the lights stay on.

With coordinated effort between government, private investors, and regional partners, Zambia can turn its energy challenges into a competitive edge and ensure sustainable growth for generations to come.

The author is Business Editor at Zambia Daily Mail

WARNING! All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express permission from ZAMBIA MONITOR.

Comments